- The Triglav Group maintained strong capital strength and liquidity in 2022, which was confirmed by the re-affirmed “A” credit ratings.

- The Group effectively managed the risks that arose or increased due to the Russian-Ukrainian war, imposed European Union (EU) sanctions, rising inflation and the situation in the financial markets.

- The planned prudent underwriting continued and market risks were kept at target levels, while pursuing the set matching of assets and liabilities and the appropriate diversification of investments.

- Development activities focused on upgrading sustainability risks and information security risks.

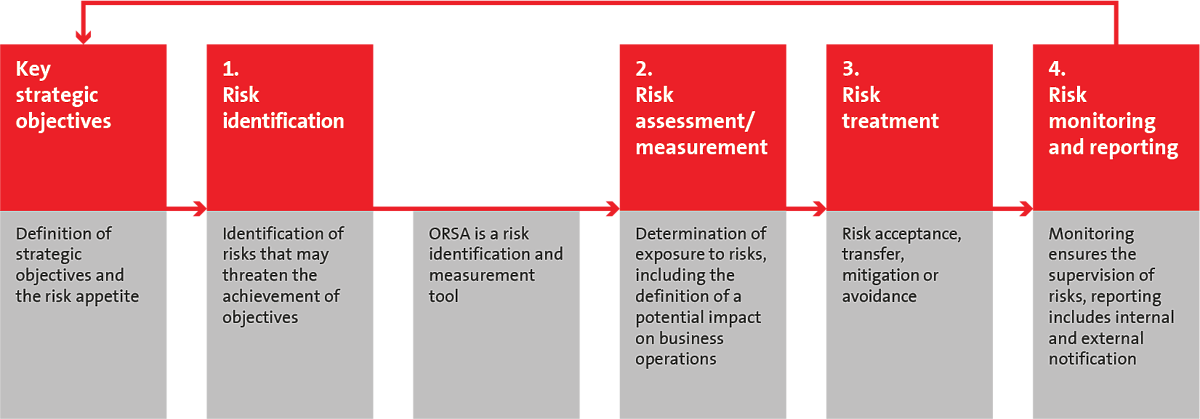

Risk Management Process

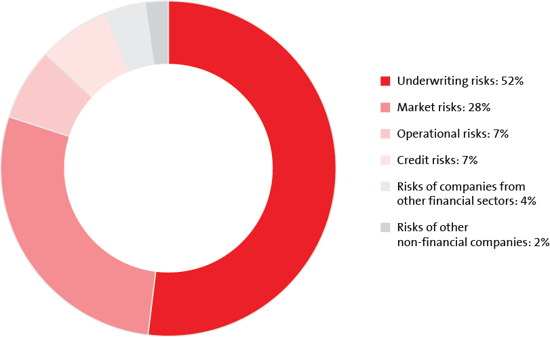

Risk profile

The risk profile shows the types of risks to which the Triglav Group is most exposed. Compared to the previous year, underwriting risks increased, whereas market risks decreased slightly. The Group continues to be most exposed to underwriting risks, followed by market, credit and operational risks.

Risk profile assessment* of the Triglav Group as at 31 December 2022

* The risk profile is determined based on risk assessment using the standard formula, without taking into account the effects of diversification across individual risk categories.

* The risk profile is determined based on risk assessment using the standard formula, without taking into account the effects of diversification across individual risk categories.

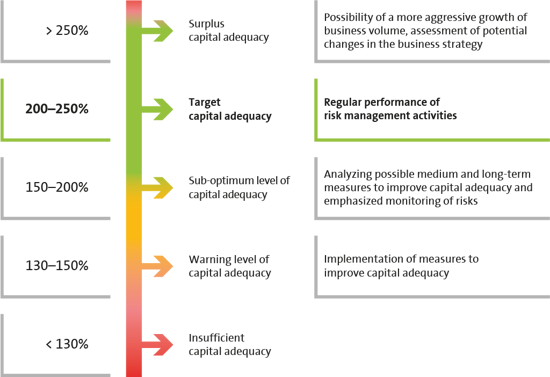

Capital management

The goal of capital management is to guarantee the safety and profitability of operations as well as a long-term and stable return on investment by paying out dividends based on the predefined criteria in the dividend policy. The Triglav Group was well capitalised as at 31 December 2022.

Capital adequacy of the Triglav Group and Zavarovalnica Triglav

| Triglav Group | Zavarovalnica Triglav | ||

| 31 Dec. 2022 | 31 Dec. 2021 | 31 Dec. 2022 | 31 Dec. 2021 |

Available own funds (EUR million) | 932.9 | 1,007.1 | 927.4 | 1,022.2 |

SCR (EUR million) | 466.5 | 459.3 | 377.1 | 374.3 |

Capital adequacy (%) | 200 | 219 | 246 | 273 |

The capital management strategic objectives and the dividend policy criteria

More details can be found in the Annual Report and the Solvency and Financial Condition Reports: