Andrej Slapar

President of the Management Board of Zavarovalnica Triglav

Dear Shareholders, Business Partners and Colleagues,

The Triglav Group's operations in 2020 were marked by the COVID-19 pandemic and the persisting low interest rate environment. In this situation, we demonstrated our resilience, maintaining our financial strength and proving our ability to adapt effectively to changes. The situation in the business environment and the capital markets had a negative impact on our profit, but we are nevertheless satisfied with the business results, as they are close to the originally planned. The difficult year behind us confirms that our strategy is well set out and that we are developing into a modern, innovative and dynamic insurance and financial group, which firmly remains the leader both in Slovenia and the wider region.

In view of the already implemented strategic projects and based on the planned projects, business continuity, reliability and client focus were ensured in all markets. We further increased our market share in the largest, Slovenian market by 0.4 percentage point to 36.5%. We are especially pleased that clients rated our work with the highest satisfaction scores to date. We are aware that employees are the main foundation of our success, thus for several years we have been strategically transforming our organisation and culture to be even more cooperative and agile. The results of our efforts are already visible. The team of over 5,300 employees in all seven markets is distinguished by diversity, appropriate stability and cooperation. We are proud that the measurements confirmed this increased satisfaction not only with clients but also with employees.

- “During the COVID-19 pandemic and the low interest rate environment in 2020, the Triglav Group demonstrated its resilience and financial strength.”

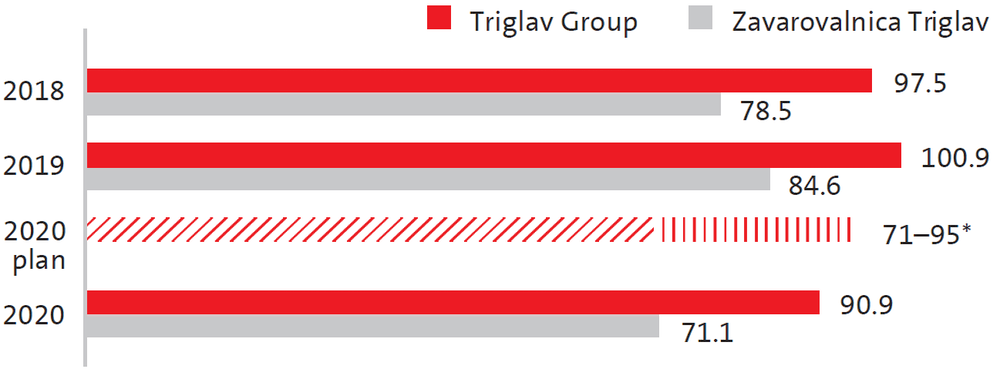

In the difficult year of 2020, we pursued our strategic commitment to the long-term and stable profitability of the Group's operations. The Group generated a profit before tax of EUR 90.9 million and achieved an 8.9% return on equity. The result is lower than originally planned and the one achieved the year before, but it is in line with the published interim estimate. It was positively influenced by our underwriting discipline, increased business volume and prudent cost management. On the other hand, the result was affected by the situation in the financial markets (a further decrease in interest income and increase in expenses due to the long-term servicing of investment guarantees), major CAT events (hail storms in three markets and the Zagreb earthquake) and an increase in insurance technical provisions due to the current business conditions. The value of the investment portfolio, which continues to be managed conservatively, grew by 5% to EUR 3,496 million. Its composition was not significantly changed. Through active investment, the shares of individual investment grades were adjusted, thus maintaining the appropriate diversification and security of the entire portfolio.

The Group with the high, “A” credit rating

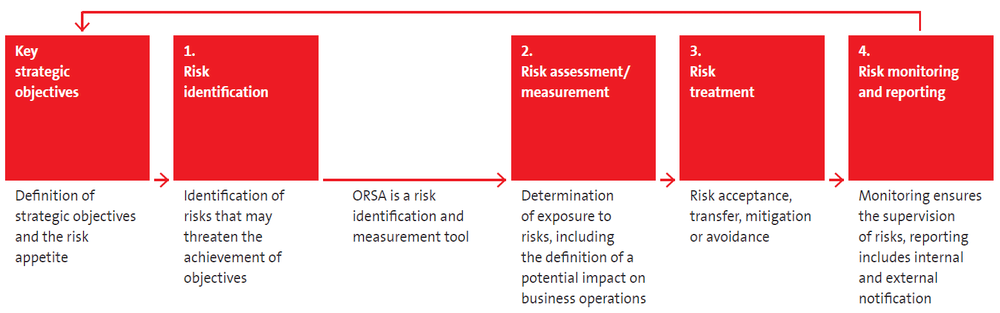

During the year, the Group assessed the impact of the situation on its operations according to different scenarios and regularly reported thereon. These assessments showed that the Group’s insurance and investment portfolios are sufficiently resilient and that its capital position is appropriate to effectively cope with any increased risks due to the COVID-19 pandemic. Through comprehensive risk management and prudent capital management, the Group ensured not only an optimal composition of the capital but also its cost-effectiveness. The Group’s strong financial stability, capital adequacy and profitability were confirmed by the credit rating agencies S&P Global Ratings and AM Best, which re-affirmed the Group’s “A” credit rating with a stable medium-term outlook. This is one of our strategic objectives, which ensures an appropriate competitive position of the Group in insurance, reinsurance and financial markets, as it reflects our financial strength and sound performance.

Good results in insurance and asset management

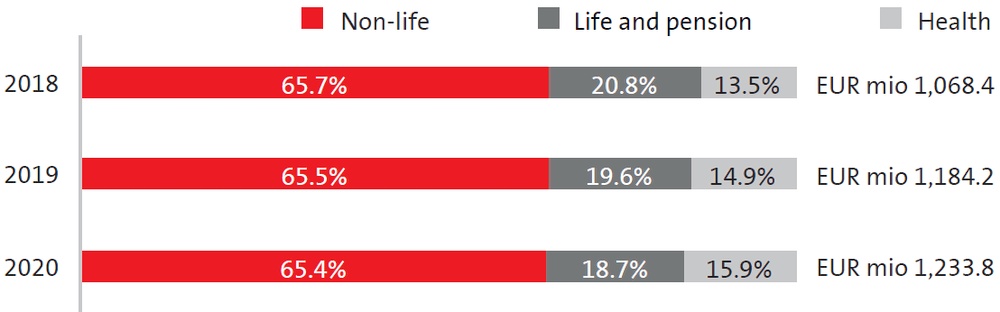

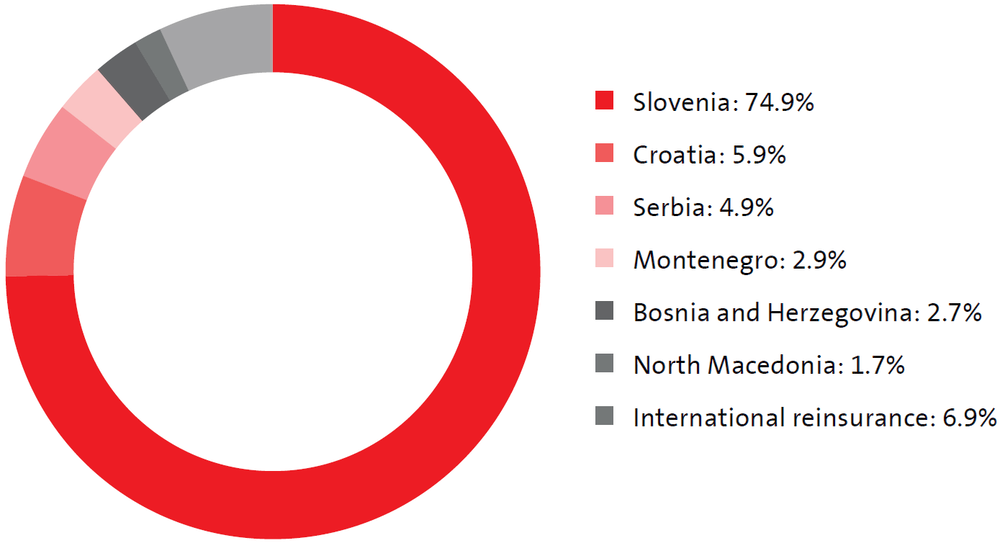

The volume of written premium rose by 4% to EUR 1,234 million, thus fulfilling the plans, although most countries in the region were marked by the decline in GDP, shrinking insurance markets and fierce competition. Non-life insurance premium increased by 4% and health insurance premium by 11%, while life and pension insurance premium remained at the same level as in the preceding year. Premium growth was recorded in most insurance markets. Growth stood at 3% in the Slovenian market, thus being at the level of market movements, and 4% in markets outside Slovenia.

- “The situation in the business environment and the capital markets had a negative impact on our profit, but we are nevertheless satisfied with our business results.”

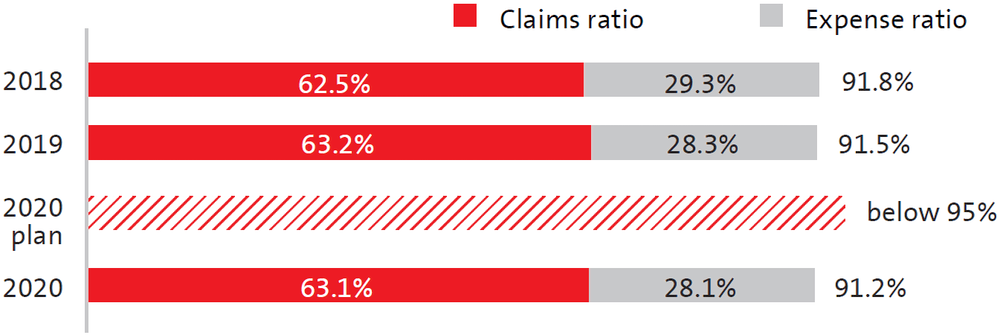

We strategically ensure geographical and product diversification of the total written premium and use an omni-channel approach to our clients. We are gradually increasing the share of premium written in markets outside Slovenia (standing at 18.2% in 2020). In addition to non-life insurance, the share of other insurance classes that are part of our offering is being strengthened (the share of non-life insurance at the Group level decreased to 65.5%). Two-thirds of written premium come from retail clients and the rest from corporate clients, whose share increased by 1.4 percentage points. In addition to major CAT events, the claims experience was affected by the pandemic. The total volume of gross claims paid was 3% lower than in 2019. In addition, we expect that a certain part of claims not incurred in 2020 due to decreased economic activity or other restrictions of the policyholders’ movement will be paid in 2021. For this purpose, appropriate insurance technical provisions were formed. The Group’s combined ratio was 91.2%, which is in the lower end of its average target strategic value range. Compared to the preceding year, it is lower by 0.3 percentage point due to an improvement in both the claims ratio and the expense ratio.

We are also satisfied with the results of the asset management business. The volume of own insurance portfolio grew by 6% to EUR 2,995 million and the volume of clients' assets in mutual funds and discretionary mandate assets increased by 5% to EUR 1,156 million. Discretionary mandate services are provided by Triglav Skladi, which also manages the investment portfolios of the Group's clients within the framework of unit-linked life insurance and guarantee funds backing supplemental voluntary pension insurance. Following the takeover of the ALTA mutual fund manager, we effectively carried out all integration procedures and brought together 110,000 clients under a single brand. With a 32.9% share in the Slovenian mutual fund market at the end of the year, we are one of the leading asset managers.

Client focus and development remain at the forefront

The new situation gave additional impetus to the overall digital business transformation of the Group. We have effectively adapted to the changed environment and the behaviour of our clients. Among the achievements that stand out are the upgraded remote business and the consistent implementation of the measures taken to curb the spread of infection and protect the health of employees, clients and other stakeholders. We upgraded and launched new products and assistance services, improved the handling of claims and introduced artificial intelligence in some processes. Furthermore, we strengthened digital sales, communication and distribution channels and tools. By enhancing our digital presence and promoting the use of online and mobile platforms, we have increased the average premium per employee, achieved higher cost-effectiveness and improved user experience by simplifying procedures for our clients.

We continued to consolidate our own sales network as our most important sales channel, where 73.3% of premium is written. In accordance with the omni-channel approach, our own sales network was supplemented with the external sales network, which contributed to premium growth in individual markets. In 2020, in line with the planned geographical diversification of operations, Zavarovalnica Triglav provided cross-border insurance services in more than 15 EU Member States. Long-term partnerships were expanded from Greece and Italy to the Norwegian and Dutch insurance markets. These forms of business, which are otherwise marginal in terms of premium volume, are considered important in terms of development.

| Key strategic guidelines |

| Long-term stable operations and increased value of the Triglav Group |

| Client focus and development of related services |

| Developing cooperative and agile organisation and culture |

Implementation of the dividend policy

In accordance with the positions of the Slovenian insurance regulator, Zavarovalnica Triglav’s shareholders approved the proposal of the Management Board and the Supervisory Board that the accumulated profit for 2019 remain undistributed. The dividend policy remained unchanged. In its implementation, depending on the circumstances, we take into account the prudent management of the Triglav Group's capital and its financial stability, the need to reinvest profit in the implementation of the growth and development strategy, and the payment of appealing dividends to the shareholders. When the business conditions will normalise, we will be able to continue to implement it by paying dividends.

Commitment to sustainability (ESG)

By pursuing our mission to build a safer future, we are realising our sustainability goals. At the end of 2020, the Triglav Group's commitment to sustainability was adopted on these principles as a formal document that sets out the direction of the Group’s development in the environmental, social and governance areas (ESG). We committed ourselves, through our activities, to reduce uncertainty in the environment, provide our clients with financial and other security, and create sustainable value for our shareholders and other stakeholders. When designing insurance products, providing services and managing its own portfolios and clients' assets, the Group considers the fundamental aspects of sustainable operations.

We will remember the previous year as one of the most difficult ever. The pandemic has brought both business and personal challenges and affected us all. We thank our clients for their loyalty, our shareholders for their trust, our employees for their dedication and effort, and all our partners for their constructive cooperation.

Andrej Slapar

President of the Management Board of Zavarovalnica Triglav

Financial highlights of the Triglav Group business plan for 2021 (EUR million)

| 2018 | 2019 | 2020 | 2021 plan |

Profit/loss before tax | 97.5 | 100.9 | 90.9 | 85–95 |

Gros written premium from insurance, coinsurance and reinsurance contracts | 1,068.4 | 1,184.2 | 1,233.8 | 1,200–1,300 |

Combined ratio in non-life insurance | 91.8% | 91.5% | 91.2% | below 95% |

Download section Strategy and plans of the Triglav Group