- The Triglav Group maintained its leading market position among insurance groups in Slovenia and Montenegro. Its market shares were either increased or maintained in most insurance markets.

- Premium growth was recorded in all insurance markets and all insurance segments.

- Due to higher inflation, gross claims paid and operating expenses increased, and it was necessary to make adjustments to premium rates.

- Escalation of the frequency of weather-related loss events additionally affected gross claims paid.

- Rising interest rates in the financial markets and falls in values in the stock markets reduced the value of financial investments, assets under asset management and returns on financial investments.

Market shares and market position of the Triglav Group in the Adria region in 2022

Market | Market share | Market share trend | Ranked in 2022 | Ranked in 2021 | |

Slovenia | 38.9% | ↑ | + 0.4 percentage point | 1 | 1 |

Croatia | 5.6% | • | 0.0 percentage point | 7 | 7 |

Serbia* | 7.3% | • | 0.0 percentage point | 5 | 5 |

Montenegro | 37.8% | ↓ | – 1.3 percentage point | 1 | 1 |

Bosnia and Herzegovina | 9.4% | ↑ | + 0.6 percentage point | 3 | 3 |

- Federation of BiH | 10.8% | ↑ | + 1.0 percentage point | 3 | 4 |

- Republic of Srpska** | 6.3% | ↓ | – 0.3 percentage point | 7 | 7 |

North Macedonia | 14.7% | ↑ | + 1.6 percentage point | 3 | 3 |

* Data for January–September 2022

** Including the market shares of Triglav Osiguranje, Banja Luka and the branch of Triglav Osiguranje, Sarajevo in Banja Luka.

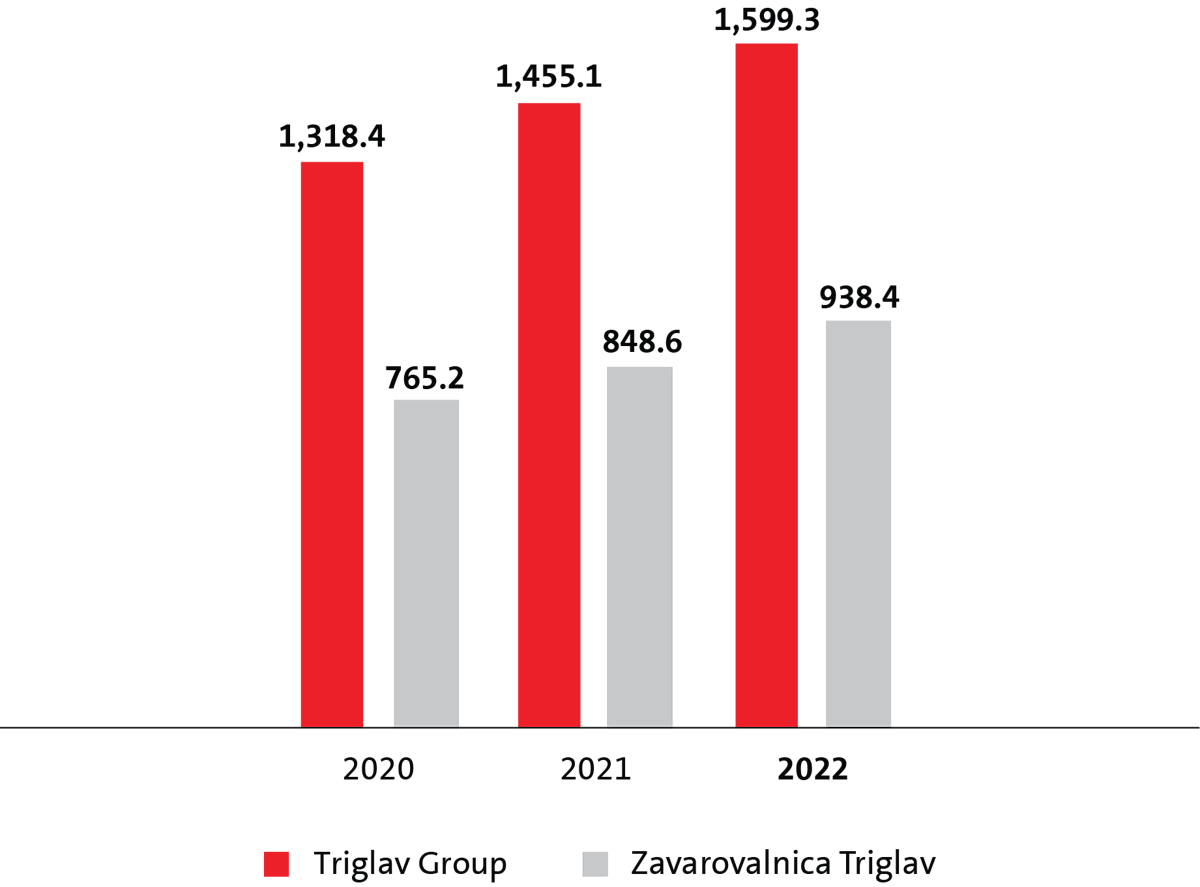

Total revenues in EUR million

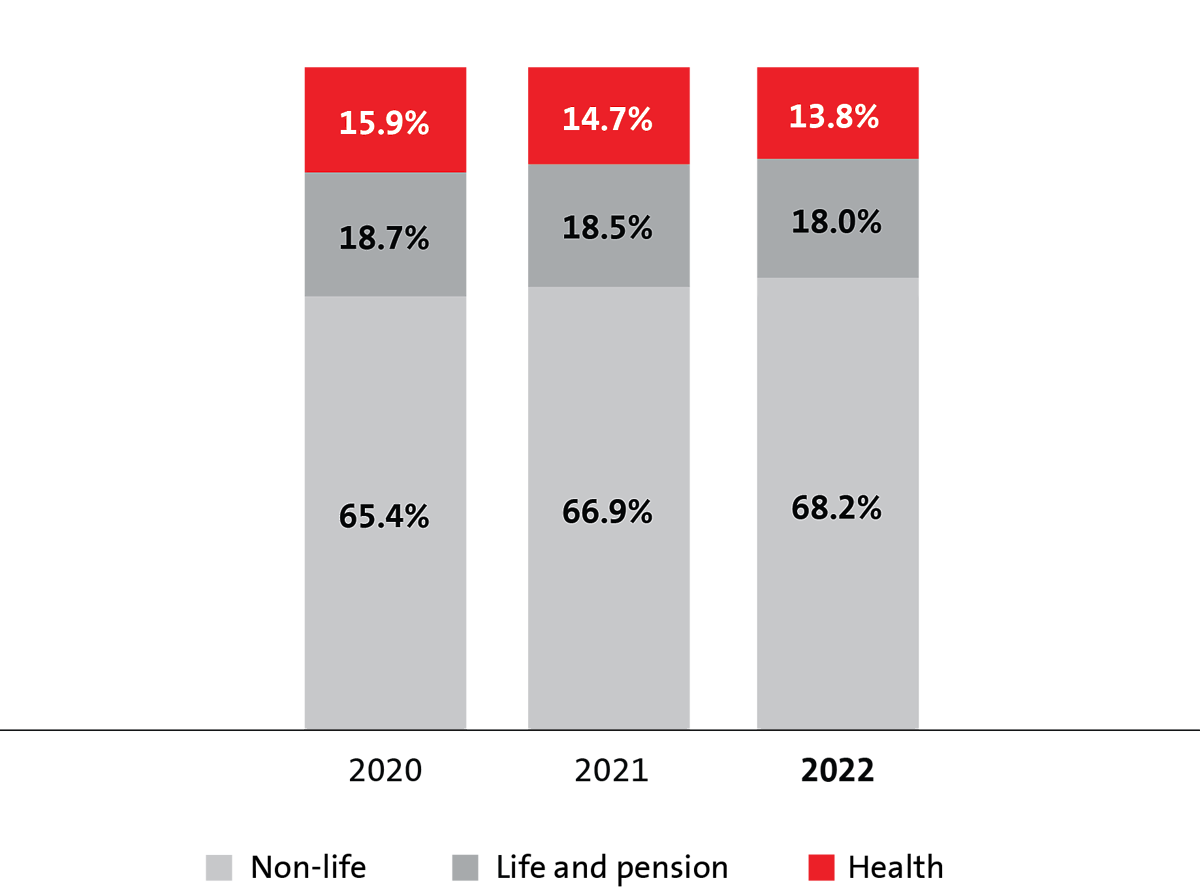

| Consolidated gross written premium of the Triglav Group by segment

|

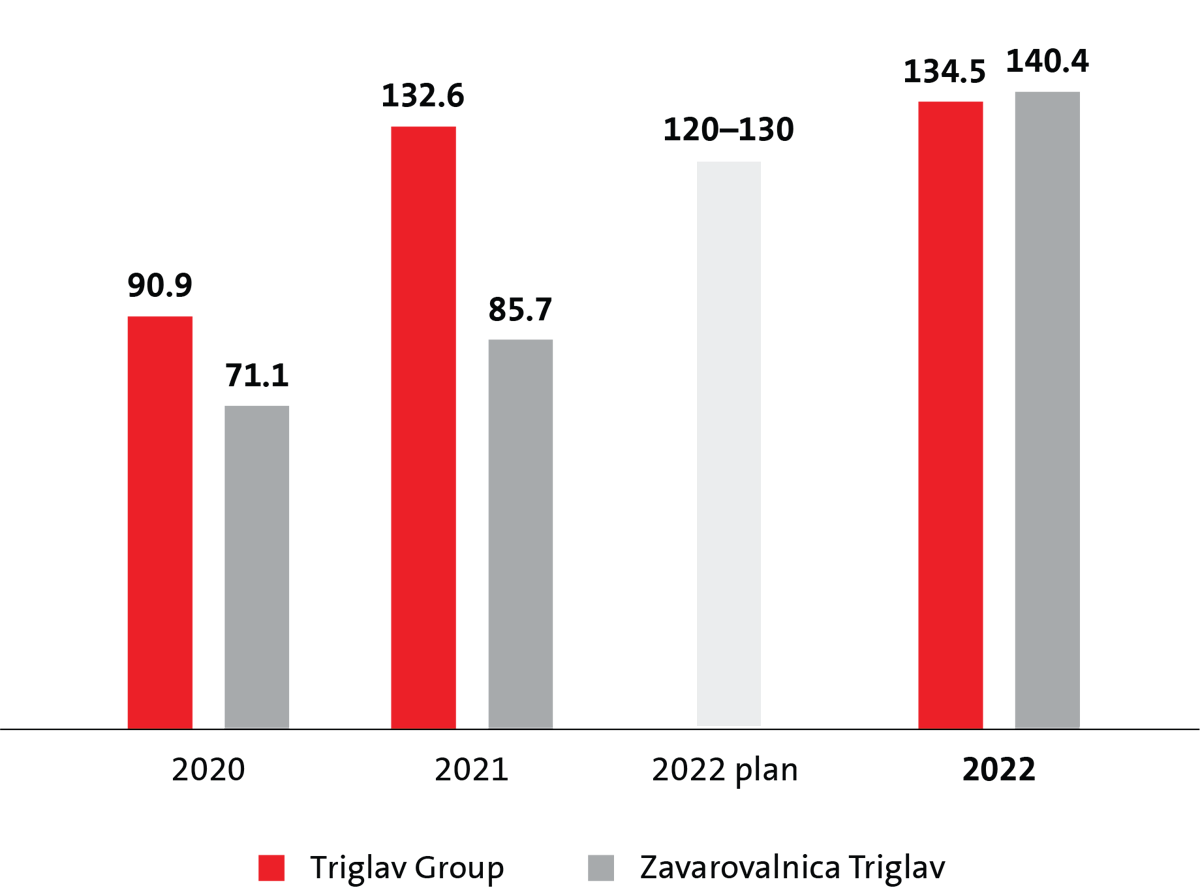

Net profit before tax in EUR million

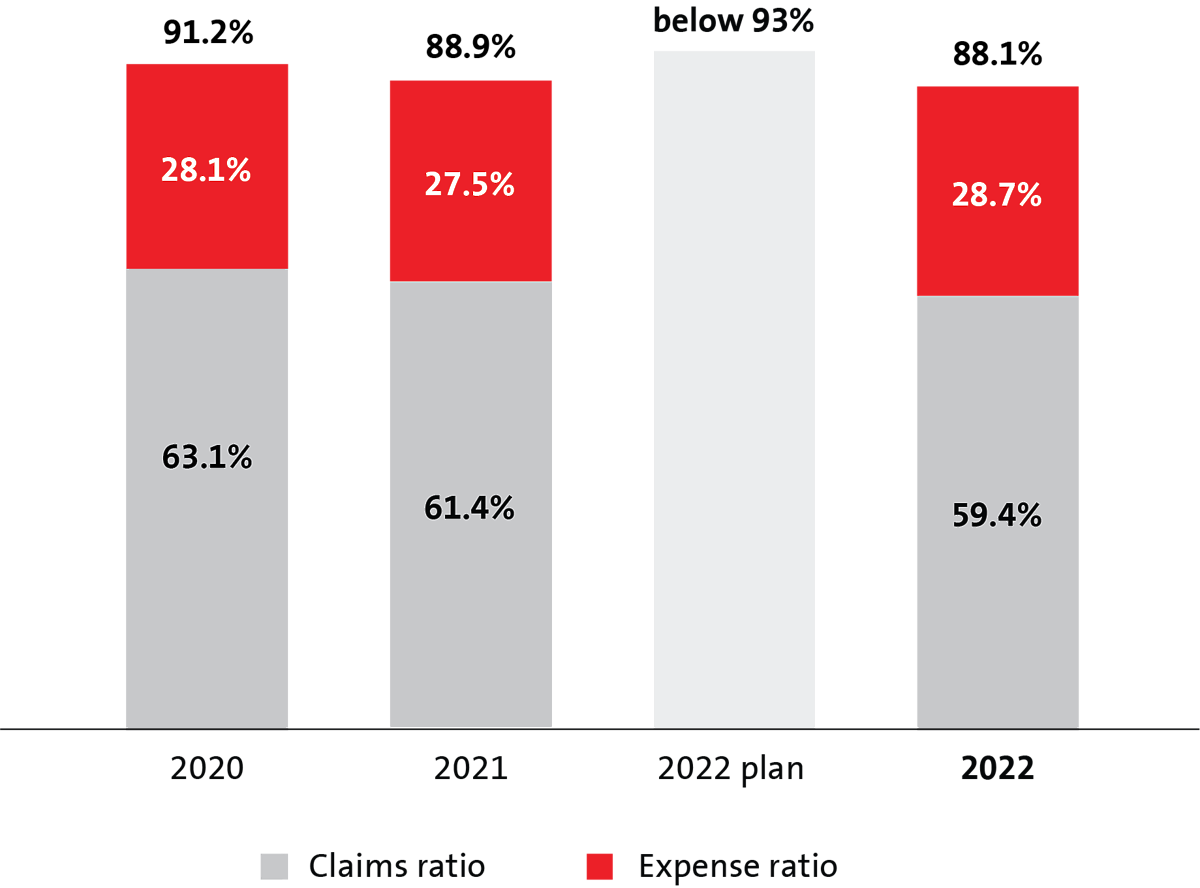

| The Group’s combined ratio in non-life and health insurance

|

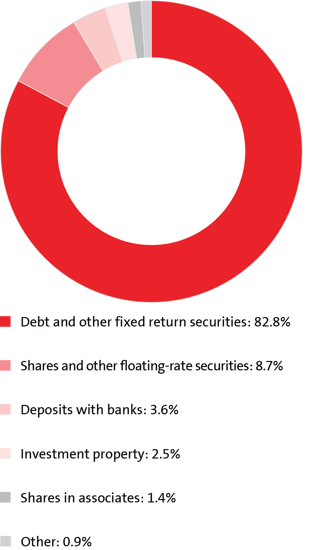

Investment structure of the Triglav Group (excluding unit-linked life insurance contract investments) as at 31 December 2022

| The structure of consolidated insurance, coinsurance and reinsurance premiums of the Triglav Group by market

|