- Despite the persisting emergency situation caused by COVID-19, the Group performed well and without interruption in 2021. Furthermore, it maintained strong capital strength and liquidity, which was confirmed by the re-affirmed “A” credit rating.

- The Group carried out the planned prudent underwriting of non-life and life underwriting risks and ensured the optimal matching of assets and liabilities, while reducing risk exposure with appropriate diversification.

- The risk management system was upgraded in terms of strategic initiatives and external potential risks. Key development activities took place in the field of sustainability risk management.

The Triglav Group was well capitalised in 2021. Its capital strength is based on its quality capital structure, which to a lesser extent also includes subordinated liabilities. The Group achieved high capital adequacy despite ongoing uncertainties in the business environment and taking into consideration the existing dividend policy. After the Insurance Supervision Agency temporarily suspended the payment of dividends in 2020, Zavarovalnica Triglav paid them again in 2021.

The Group’s adequate capital and financial strength was additionally confirmed by the long-term credit rating of “A” and the financial strength rating of “A” assigned to the Group by the credit rating agencies S&P Global Ratings and AM Best. Both ratings have a stable medium-term outlook.

Zavarovalnica Triglav’s adequate liquidity was maintained through regular management of its liquidity risk.

Capital adequacy of the Triglav Group and Zavarovalnica Triglav

| Triglav Group | Zavarovalnica Triglav | ||

| 31 Dec. 2021 | 31 Dec. 2020 | 31 Dec. 2021 | 31 Dec. 2020 |

Available own funds (EUR million) | 1,007 | 968 | 1,022 | 983 |

SCR (EUR million) | 459 | 404 | 374 | 318 |

Capital adequacy (%) | 219 | 240 | 273 | 309 |

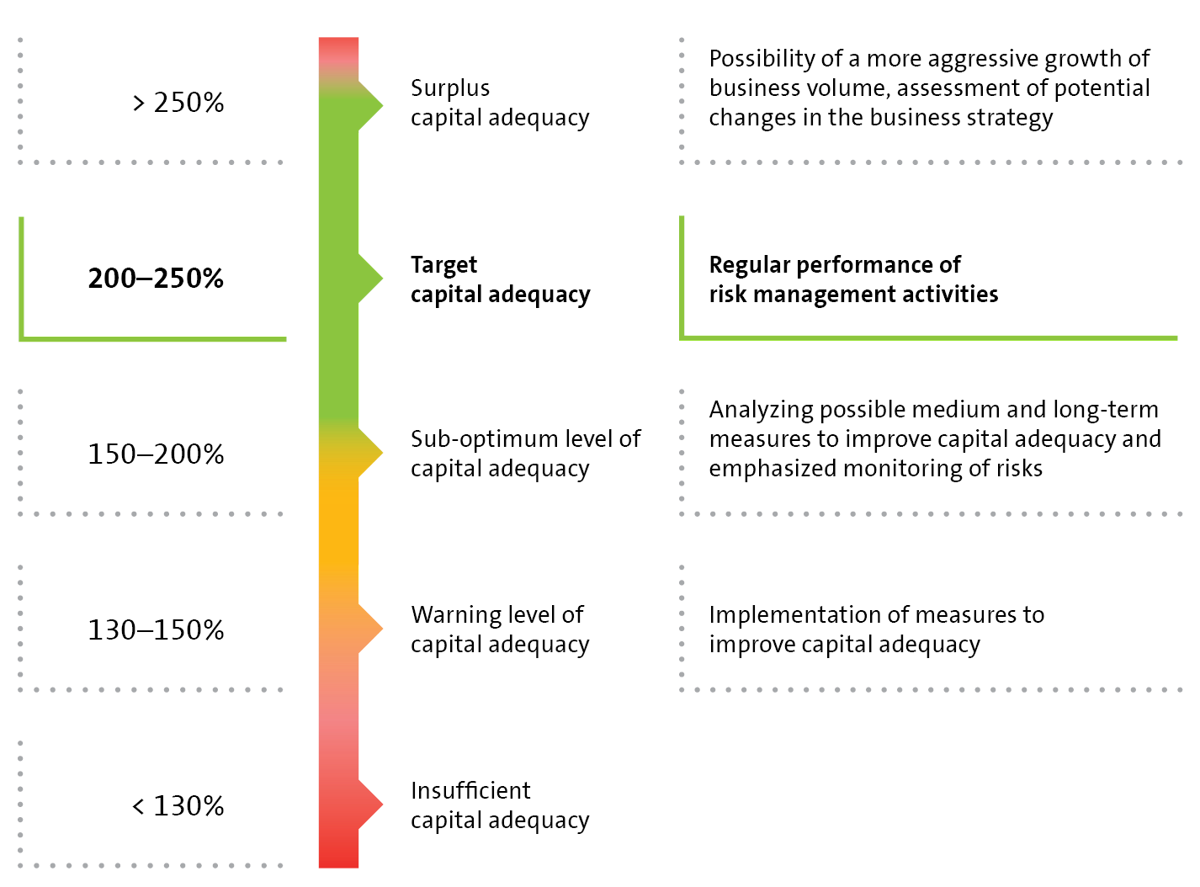

The capital management strategic objectives and the dividend policy criteria

Sustainability risk management as part of comprehensive risk management at the Triglav Group

Following the adoption of the Triglav Group’s commitment to sustainability in 2020, the content related to sustainability and sustainability risks was upgraded in 2021 with the Group’s strategic ambitions in this field, incorporating care for sustainable development into the Company’s organisational structure. The Company is building a comprehensive sustainability risk management system; sustainability risks are part of non-financial risks. To this end, the risk appetite and internal risk management rules were defined for sustainability risks. At Group level, sustainability-related activities are coordinated and directed by the Sustainable Development Coordinator. The Company’s risk management function is responsible for the optimal integration of sustainability aspects of business into the risk management system, which are monitored by the Compliance and Sustainable Development Committee. The latter reports to the Risk Management Committee, which is responsible for the comprehensive management of the Group's most material risks. Decisions are made by the Management Board.

Following the adoption of the Triglav Group’s commitment to sustainability in 2020, the content related to sustainability and sustainability risks was upgraded in 2021 with the Group’s strategic ambitions in this field, incorporating care for sustainable development into the Company’s organisational structure. The Company is building a comprehensive sustainability risk management system; sustainability risks are part of non-financial risks. To this end, the risk appetite and internal risk management rules were defined for sustainability risks. At Group level, sustainability-related activities are coordinated and directed by the Sustainable Development Coordinator. The Company’s risk management function is responsible for the optimal integration of sustainability aspects of business into the risk management system, which are monitored by the Compliance and Sustainable Development Committee. The latter reports to the Risk Management Committee, which is responsible for the comprehensive management of the Group's most material risks. Decisions are made by the Management Board.