Dear Shareholders, Business Partners and Colleagues,

Dear Shareholders, Business Partners and Colleagues,

In 2021, we operated in an environment of persisting COVID-19 pandemic and fierce competition as well as under the influence of trends in the capital markets, which remained unfavourable in terms of interest income. Even under such circumstances, we achieved very good results – better than expected. The Group consolidated its position in most markets, maintained its financial strength and again received “A” credit ratings from S&P Global Ratings and AM Best with a stable medium-term outlook.

- The consolidated profit before tax, amounting to EUR 132.6 million, was 46% higher than in the previous year.

The consolidated profit before tax, amounting to EUR 132.6 million, was 46% higher than in the previous year. Net return on equity was 12.5%. With prudent cost management, primarily acquisition costs, digitalisation expenses and investments in information technology increased. We achieved very good results in both underwriting activities and the management of clients’ assets, while investment portfolio returns continued to be affected by the low interest rate environment. Several factors contributed to underwriting results. Along with growth in the volume of business, they were positively affected by the relatively lower frequency of claims and the favourable development of claims provisions created in past years. They were further affected by the formation of insurance technical provisions in 2021, which was prudently conservative as always. To a lesser extent, additional insurance technical provisions were created in the health, life and pension insurance segments.

Good results in insurance and asset management

The Group’s total revenue increased by 10% to EUR 1,455.1 million, and the volume of gross written premium increased at the same growth rate to EUR 1,353.0 million. The Group’s underwriting discipline and client focus resulted in premium growth in all three insurance segments and in all our markets. In Slovenia it stood at 4%, which is one percentage point above the market, reaching 15% in markets outside Slovenia. Premium written in the international market based on the principle of free movement of services and inward reinsurance premium grew by 40%. The non-life insurance premium increased by 12%, life and pension insurance premium by 8% and health insurance premium by 1%.

- The Group’s underwriting discipline and client focus resulted in premium growth in all three insurance segments and in all our markets.

The volume of gross claims paid of EUR 736.6 million did not deviate significantly from the previous two years. They were affected by the growth of the insurance portfolio over several years and major CAT events, which were even lower than the year before. As we observed during the year, the claims segment continued to be affected by the COVID-19 pandemic, resulting in a lower frequency of claims in some insurance classes and an increased volume of claims in others due to last year’s disruption in some services. The combined ratio in non-life and health insurance reached a very favourable 88.9%. Its improvement is the result of the improved claims ratio and the expense ratio or higher growth in net premium income than growth in net claims incurred, backed by the rise in other insurance income and the decline in net expenses for bonuses and discounts.

The Group’s investment portfolio – together with investment property and investments in associates – amounted to EUR 3,668.5 million, which is 5% more than the year before. Its structure was not significantly changed, but we continued to pursue the goal of achieving a high credit rating of the entire portfolio in our investing activities. We also began to incorporate environmental, social and governance (ESG) factors in our investment processes. We are satisfied with the results in asset management, in which the volume of clients’ assets in mutual funds and discretionary mandate assets increased by 33% to EUR 1,529.3 million due to the situation on the financial markets and net inflows. By holding a 31.8% market share, the Group is one of the leading managers of assets in mutual funds in Slovenia.

Implementation of the dividend policy by paying out dividends

We strive to make the ZVTG share a profitable, safe and stable investment for investors. Our dividend policy is sustainable in terms of the Group’s financial stability, growth and development, and interesting in terms of paying attractive dividends to shareholders. We aim to implement it as such, but in 2021 it was again influenced by the COVID-19 pandemic and related requirements of the insurance regulator. We are pleased to have met its requirements and to have been able to pay dividends in 2021. A total of 53% of Zavarovalnica Triglav’s consolidated net profit for 2020 was allocated for dividend payments, which represented a 5% dividend yield.

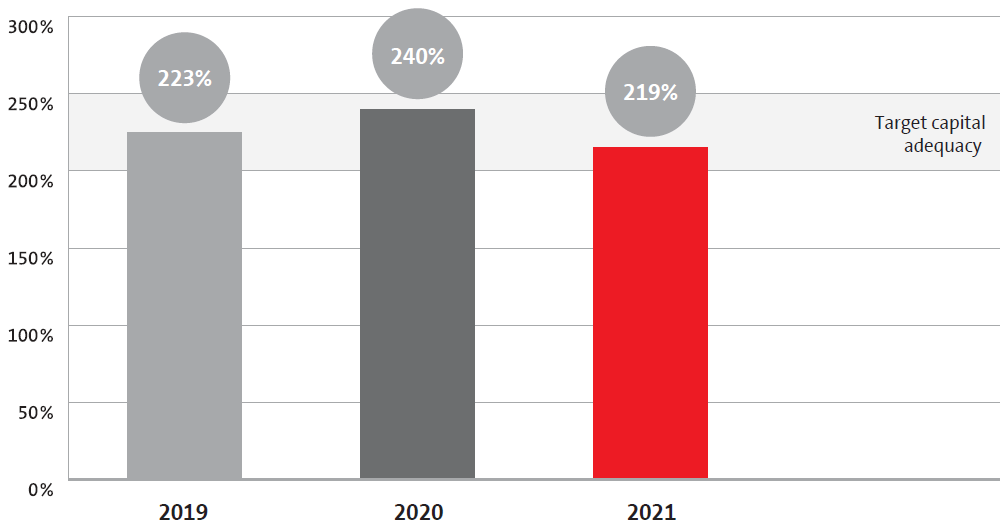

Capital adequacy ratio of the Triglav Group as at 31 December 2021

Focused on growth and development

The Group’s operations continued to be development-oriented in 2021. In both activities, insurance and asset management, we have strengthened client focus and user experience, with the aim of making it outstanding and uniform across all channels and processes, products and Group companies. This remains our main strategic guideline in the future.

The Group’s long-term competitive advantage is the upgrading of insurance and financial products with assistance and related services, which are supported by advanced information and digital solutions. In such business ecosystems, we work together with a partner network of contractors and upgrade them in several areas (healthcare services, pet health, safe and sustainable mobility, carefree and safe living/home and financial services). In 2021, new, simple and flexible products (e.g. modular insurance) were launched, which provide clients with an even greater selection of insurance scope and coverage to choose from, further expanding the range of assistance services.

Development processes continued to be carried out in order to facilitate policy underwriting, claim reporting and the digitalisation of back-office processes. In line with our omni-channel approach, traditional distribution channels were connected with new channels (digital sales, strengthened bank channels, mobile operators), in addition to implementing a hybrid sales method (remote selling and personal contact). Due to the unstable situation caused by the COVID-19 pandemic, the sales network as the Group’s main sales channel focused on remote selling.

The client relationship management information system was upgraded in terms of function and data, while the functionalities of the i.triglav digital office and online applications intended for clients in both core activities were expanded. Our contact with clients was maintained through a variety of communication channels (including live/web chat and a chat operated by a digital assistant, i.e. a chatbot), which will be upgraded with the project of establishing a central entry communication point.

In accordance with the planned geographical diversification of operations, we entered into new strategic partnerships, launching operations in Poland and Denmark and expanding our current presence in Greece, Italy, Norway and the Netherlands. These forms of business, which are insignificant in terms of premium volume, are considered material in terms of development.

Sustainability orientation (ESG) is a part of us

- We aim to play a leading role in our region in integrating the best global ESG practices into our operations.

Sustainability is integrated into our operations and expressed in our mission of building a safer future. By pursuing sustainable development, the Group is creating a long-term stable basis for its profitable and safe operations, promoting the transition to a sustainable society and reducing its impact on climate change. We aim to play a leading role in our region in integrating the best global ESG practices into our operations. We have defined our sustainable (ESG) ambitions by 2025 in four key areas, which include improvements in communication about our sustainable business practices. Therefore, in this annual report, at the request of investors and shareholders, disclosures according to Sustainability Accounting Standards Board (SASB) were added to the long-term application of the Global Reporting Initiative (GRI) criteria and standard.

Development-oriented revised strategy to 2025

The new financial year has begun with a revised strategy to 2025, which has set ambitious strategic objectives on a solid foundation. These objectives were upgraded in terms of development and highlight our continued efforts to focus on the client. We will continue with the digital transformation and, together with our partners, we will develop service-oriented business models and ecosystems. The Group's operations are planned to remain profitable and safe. The Group, with its sustainability-oriented operations, continues to provide a development-oriented and friendly environment to its employees.

- The new financial year has begun with a revised strategy to 2025, which has set ambitious strategic objectives on a solid foundation.

It means a great deal to us that clients are satisfied with our work by rating the Group the highest to date. A high level of satisfaction was also expressed by our employees, which is the foundation of our success. On behalf of the Management Board, I sincerely thank all employees for their efforts.

Andrej Slapar

President of the Management Board of Zavarovalnica Triglav