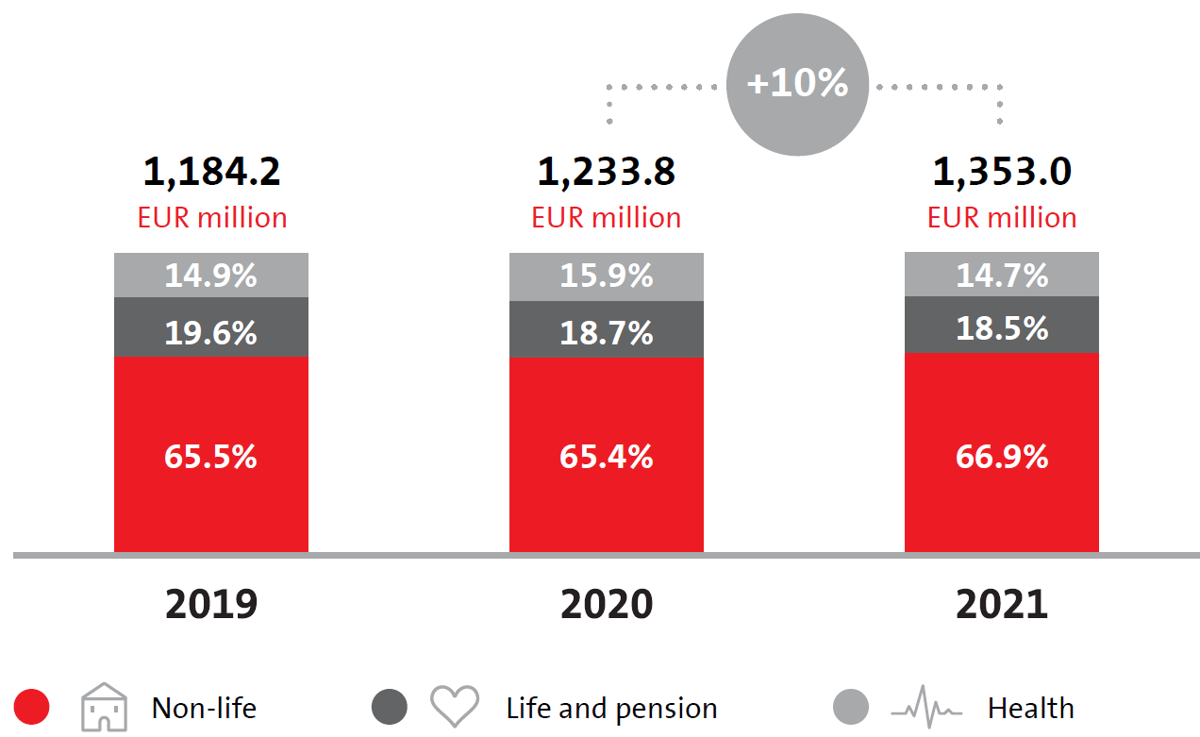

- Economic growth has driven a positive trend in written premium in the Triglav Group markets.

- Premium growth was recorded in all insurance markets and in all insurance segments.

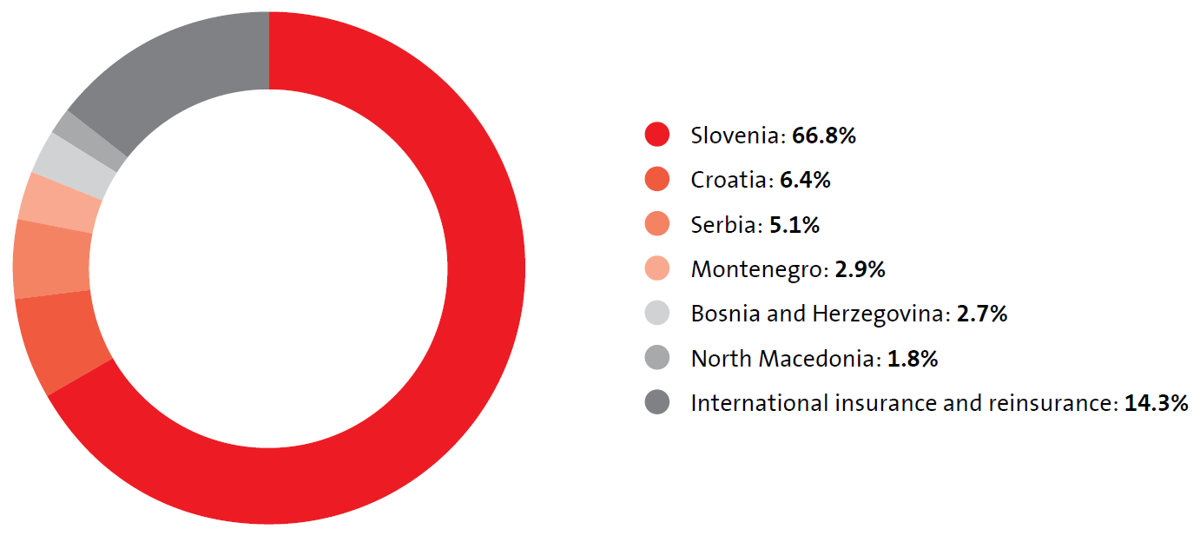

- The Triglav Group maintained its dominant market position in Slovenia, Montenegro and North Macedonia and improved its market share in most insurance markets.

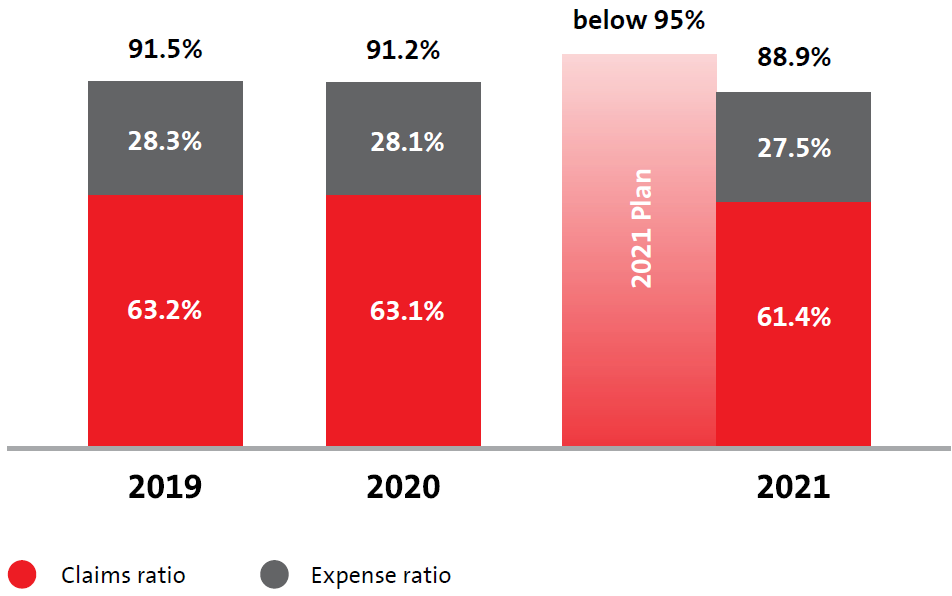

- High profit growth due to higher business volume and lower claim frequency as a result of the COVID-19 pandemic.

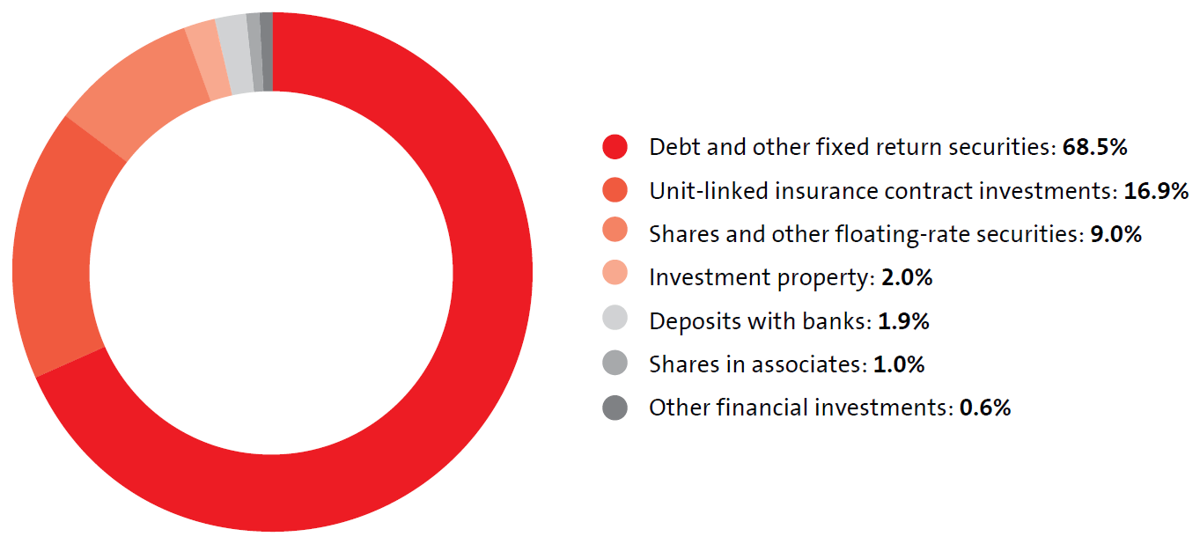

- Low interest rates continued to reduce rates of return on investment.

Market shares and market position of the Triglav Group in 2021

Market | Market share | Market share trend | Ranked in 2021 | Ranked in 2020 | |

Slovenia | 38.6% | ↑ | + 2.1-percentage point | 1 | 1 |

Croatia | 5.6% | ↑ | + 0.3-percentage point | 7 | 8 |

Serbia* | 7.3% | ↑ | + 0.4-percentage point | 5 | 5 |

Montenegro | 39.0% | ↑ | + 0.3-percentage point | 1 | 1 |

Bosnia and Herzegovina | 8.6% | • | 0.0-percentage point | 4 | 4 |

- Federation of BiH | 9.6% | ↓ | – 0.1-percentage point | 5 | 5 |

- Republic of Srpska** | 6.6% | ↑ | + 0.4-percentage point | 7 | 7 |

North Macedonia | 13.2% | ↑ | + 0.3-percentage point | 1 | 1 |

* Data for January–September 2021.

** Including the market shares of Triglav Osiguranje, Banja Luka and the branch of Triglav Osiguranje, Sarajevo in Banja Luka.