In both activities, insurance and asset management, we have strengthened client focus and user experience, with the aim of making it outstanding and uniform across all sales channels and all processes, products and Group companies. This remains our main strategic guideline in the future, which we address with a wide range of interrelated activities.

Focusing on an outstanding client experience

With flexible products, such as modular insurance, the Group strives to offer clients a wide range of insurance scope and coverage, and by digitalising processes and focusing on a uniform and outstanding user experience enable clients to choose the most appropriate form of cooperation at any stage.

The planned development projects were successfully completed. The Group’s efforts remain focused on flexible products and services based on proactive risk identification and comprehensive risk management. In this way, the Group strives to improve its clients’ financial security in all stages of their life and business development, adapt to trends in society, especially demographic and technological, and support changes to reduce climate impacts.

Development of sales processes and channels

Sales and after-sales processes are being upgraded by transforming the traditional way of selling insurance into a hybrid way, which enables both remote selling and personal contact. Due to the unstable epidemic situation, the sales network as the Group’s main sales channel focused on remote selling. Contact with clients was maintained via various communication channels, including personal contact, depending on the available options.

New forms of partnerships

The Group is increasing its volume of business by entering into strategic alliances or partnering with companies and other partners in its markets and beyond. In this way, it is reducing business uncertainties, overcoming its geographical limitations and improving the expertise and content of services provided to its clients. In 2021, it offered a number of new forms of insurance protection to its partners and clients. Thanks to the high level of automation and digitalisation of cooperation, they also experienced an enriched and friendlier sales experience.

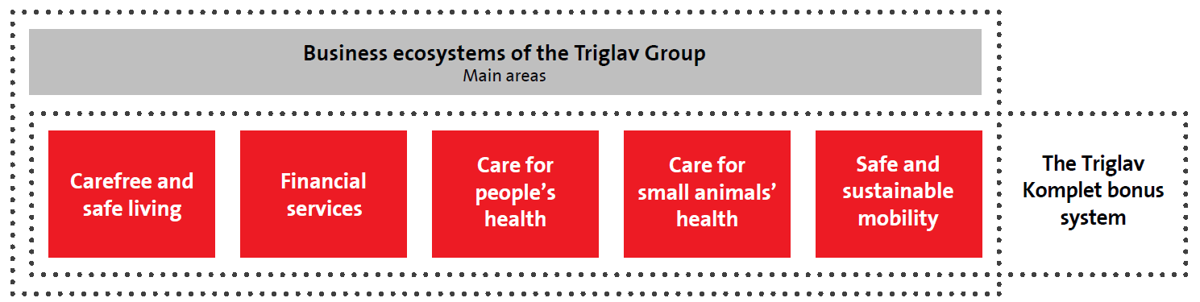

Business ecosystems

Products and services that generate new value for clients and other stakeholders are designed by developing business ecosystems, thereby expanding the Group’s market presence and creating new sales opportunities. The Group’s main long-term competitive advantage is the upgrading of insurance and financial products with assistance and related services, which are provided together with a partner network. In this way, a comprehensive solution to clients’ needs is ensured in addition to their financial security. The main building blocks of any ecosystem are assistance services expanded by related services, which are supported by advanced information and digital solutions.

Development of insurance products and services

Identification of client needs and expectations of individual markets was reflected in the development and redesign of insurance products and services. As in previous years, the focus in 2021 was on their simplicity, comprehensiveness and transparency, as well as on strict compliance with legal and other regulatory requirements. Regular adjustment of insurance terms and conditions, such as tariffs, conditions and guidelines for underwriting, remains crucial for improving underwriting results.

Business digitalisation

Development processes continued to be carried out in order to facilitate policy underwriting, claim reporting and the digitalisation of back-office processes. Focus was on fostering paperless operations.The client relationship management information system was upgraded in terms of function and data, while the functionalities of the i.triglav web office and online applications intended for clients in both core activities were expanded.

Development activities related to asset management

The Triglav Group's client-centric approach also plays a key role in asset management in achieving competitive advantages over other investment solution providers. Due to the market concentration of asset management services within larger banking and insurance groups, more attention is paid to developing a recognisable brand. The Group identified these changes and responded to them through the active and targeted adjustment of its range of products and services.