Dear Shareholders, Business Partners and Colleagues,

Dear Shareholders, Business Partners and Colleagues,

The Triglav Group actively pursued the strategic guidelines outlined in its strategy until 2022. The results confirm that we have been successful.

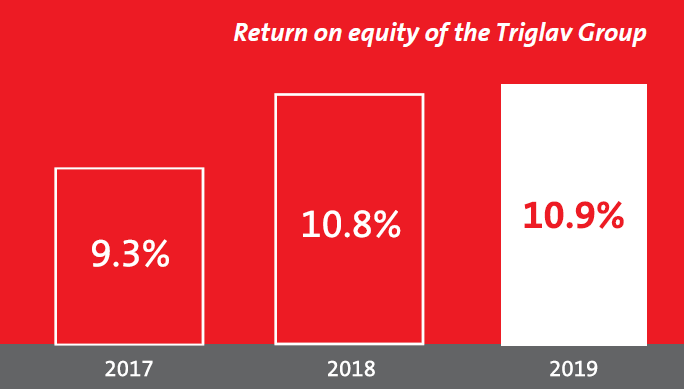

Ensuring long-term stable and profitable operations and increasing the value of the Triglav Group is the first of three guidelines set in order to achieve its mission and create a more secure future for all our stakeholders. Profit before tax increased to EUR 100.9 million in 2019, slightly exceeding the upper end of the planned EUR 100 million. Return on equity (ROE) stood at 10.9% as at the 2019 year-end (compared to 10.8% in the previous year), which is in line with our strategic objective of exceeding 10%. This was also a result of returns on investment, which were higher due to one-time events even though interest income continued to decline due to financial market conditions. The composition of our investment portfolio worth EUR 3.3 billion did not substantially change, but we extended its maturity, reduced market risks and actively adjusted the shares of individual investment grades.

Good results in both core activities – insurance and asset management

We are pleased with the results in both pillars of our business, i.e. insurance and asset management. The volume of written premium rose by 11% to EUR 1.2 billion, while taking a disciplined approach to underwriting risks. Gross premium growth was recorded on all insurance markets and in all insurance segments. The Group continued to strategically diversify premiums in terms of products and geographical areas. With respect to the latter, we again increased the share of premium written on markets outside Slovenia, which stood at 18.1% as at the end of the year. The performance of the claims segment was as expected, while the volume of claims as a result of major CAT events was lower than the year before. The Group’s combined ratio was favourable, standing at 91.5%, which is in the lower end of the range of its average target strategic value. In our asset management activity, we increased the volume of clients’ assets managed in mutual funds and through discretionary mandate services by 68%. The significant increase allows us to develop this activity more ambitiously, and it was influenced not only by the acquisition of ALTA Skladi, but also by the situation on the capital markets and net inflows. With a 34% market share, the Group holds a leading position among Slovene mutual fund managers (compared to 24.6% a year earlier).

- 34% market share among Slovene mutual fund managers (2018: 24.6%)

The Group’s focus on profitable and safe operations was closely linked with adopting new ways of doing business, and all development steps were assessed in terms of target risk-adjusted return. The Group’s financial stability is confirmed by the re-affirmed »A« credit rating with a stable medium-term outlook. With eleven insurance companies, the Triglav Group remains a firm leader in the Adria region, which has great potential; therefore, we will remain focused on existing markets in the long run. Through the establishment of a new company, the Group entered the Macedonian market in the pension insurance segment. Our growth is organic, but takeovers are not ruled out if an opportunity arises. For operations outside the existing markets, we are developing new business approaches and models with partners. In 2019, we participated in the partnership scheme for selling motor vehicle insurance in Greece, which was set up as a pilot project a year earlier. It proved to be a success, and we are now expanding this type of partnership to the Italian market by providing warranty insurance. Even though this represents only a small part of our business in terms of premium volume, it is important for the Group’s development.

- "With eleven insurance companies, the Triglav Group remains a firm leader in the Adria region.„

Through comprehensive risk management as well as prudent capital management, the Company ensures not only an optimal composition of the capital but also cost-effectiveness. As part of its regular activities, the Company issued a 30.5-year subordinated bond with great success, replacing the subordinated bond that expires in 2020. Our dividend policy is linked to our capital management policy and the achievement of our target capital adequacy. The dividend policy is both appealing and sustainable. As such, it provides our shareholders with a high dividend yield, which stood at 7.5% at the end of the year, and a total return of 17.4%.

Interdisciplinary process development aimed at providing best user experience

The Group's second strategic guideline is focusing on its clients. The driving force of development activities in both pillars of our core business is focused on the activities that are directly visible to clients, while improving our internal operations. We have made great progress in making the Group’s operations lean as well as improving cost and process efficiency (improved management practices and techniques, enhanced information and data system, even more efficient support functions, internal processes, etc.). Development activities in which all Group members participated were managed interdisciplinarily by the parent company. Our common goal is to provide clients with a superior experience in doing business with us.

As our goal is to provide complete and simple to our clients, we have continued with the extensive redesign and development of our products in 2019, also upgrading them with support and advisory services. Furthermore, we have developed new technological solutions, which contribute to greater responsiveness and transparency in taking out insurance and settling claims, in addition to improving fraud identification. We respond to dynamic changes in the environment by designing modern solutions for our clients' financial security, which is why we were the first in the region to offer cyber insurance for businesses.

As our goal is to provide complete and simple to our clients, we have continued with the extensive redesign and development of our products in 2019, also upgrading them with support and advisory services. Furthermore, we have developed new technological solutions, which contribute to greater responsiveness and transparency in taking out insurance and settling claims, in addition to improving fraud identification. We respond to dynamic changes in the environment by designing modern solutions for our clients' financial security, which is why we were the first in the region to offer cyber insurance for businesses.

As we deepen our relationship with our clients, we also shape their proactive attitude towards risks. Business digitalisation and an efficient sales network, which is one of the Group’s strongest competitive advantages, play a special role in this. In line with the strategy incorporating an omni-channel sales approach, the Group’s own sales network is complemented by the strengthened external network and other external sales channels, particularly partnerships with banks and companies selling cars and providing telecommunication services. Our online sales activity is also being upgraded. In this context, the website www.triglav.si was updated, in addition to increasing the functionality of the i.triglav digital office. Digital visibility is enhanced by advanced technological services such as Drajv (Drive), Triglav vreme (Triglav Weather) and Vse bo v redu (Everything Will Be Alright). They are also available at Triglav Lab, our technological centre and training ground for digital business, which is of particular interest to young people. There, visitors can gain valuable experience through simulators and virtual reality, become better prepared to respond effectively in the face of a natural disaster or traffic accident, and take a safe driving course. We want to be a lifelong partner to our clients, which not only provides them with financial security, but also helps them solve problems in different areas and circumstances.

Working together with the social environment

Working together with the social environment

The third focus of the Triglav Group's strategy is organisation and culture. It is important that we as a team of over 5,200 employees are able to work in a harmonious, cooperative and most stimulating work environment. To this end, numerous activities and measures were carried out in the area of rewards, communication and training. The measurement of organisational vitality, which has been used for many years to determine the level of employee satisfaction and engagement, has shown that we have maintained a high level of internal vitality, even slightly exceeding results regarding most of the main indicators.

By being committed to stable long-term effective operations and high standards of corporate governance, we undertook many activities with the goal of caring for the social environment and protecting the natural environment. The parent company’s carbon footprint and electricity consumption were reduced by 6% and 3% respectively, and the monitoring of sustainable development indicators in the Group members was further expanded. We have increased the volume of investments in prevention as part of the Group’s contribution to the sustainable development of the community. Investments primarily focus on promoting traffic safety and reducing other relevant risks. We have established an omni-channel presence, backed by an innovative approach and the new vozimse.si online platform.

I would like to thank all the stakeholders of the Triglav Group for their trust and contribution to our good business results. Together, we have proven that we are successfully combining tradition and the future, which is without a doubt one of the best ways to celebrate the Company’s 120 years in business.

Andrej Slapar

President of the Management Board of Zavarovalnica Triglav