Andrej Slapar, President of the Management Board of Zavarovalnica Triglav, presents his view on the 2018 business results and highlights the implementation of the revised Triglav Group Strategy.

How do you see the performance of the Triglav Group in 2018?

We are pleased that 2018 was another successful year. Profit before tax amounted to EUR 97.5 million which was 15% more than in 2017. The originally planned figure was between EUR 80 and 90 million, but that was outperformed mainly thanks to the high premium growth, favourable claims experience and several one-off events. Return on equity was 10.8%.

The Group’s insurance business was profitable as is reflected in the combined ratio of 91.8%. In total premium, the Triglav Group booked EUR 1,068.4 million. In recent years, we have been operating in a record low interest rate environment, which has had an unfavourable impact on our performance, particularly via financial investments. As a result, regular return on financial investments again decreased in 2018.

We are an insurance/financial group with high »A« credit ratings and a stable medium-term outlook, which both credit rating agencies reaffirmed in 2018.

How did you perform in the insurance business?

The macroeconomic conditions in the region are improving and positively influence our insurance markets. Their growth is adequately reflected in our performance. In tight competition Triglav benefited from its strong competitive advantages, intensified sales activities and improved services to cater for our clients. Our activities were finely tuned to the level of development and specificities of individual markets.

The results achieved are encouraging. Premium increased by as much as 7% and resulted in higher written premium volumes in all three insurance segments. With almost 66% non-life insurance premium, which grew by 8% in 2018, accounted for the bulk of consolidated premium. Furthermore, premium growth was recorded in most non-life insurance classes. Written premium in health insurance increased by 11%, primarily as a result of new insurance contracts and partly due to a higher supplemental health insurance premium. Life insurance premium rose by 2%.

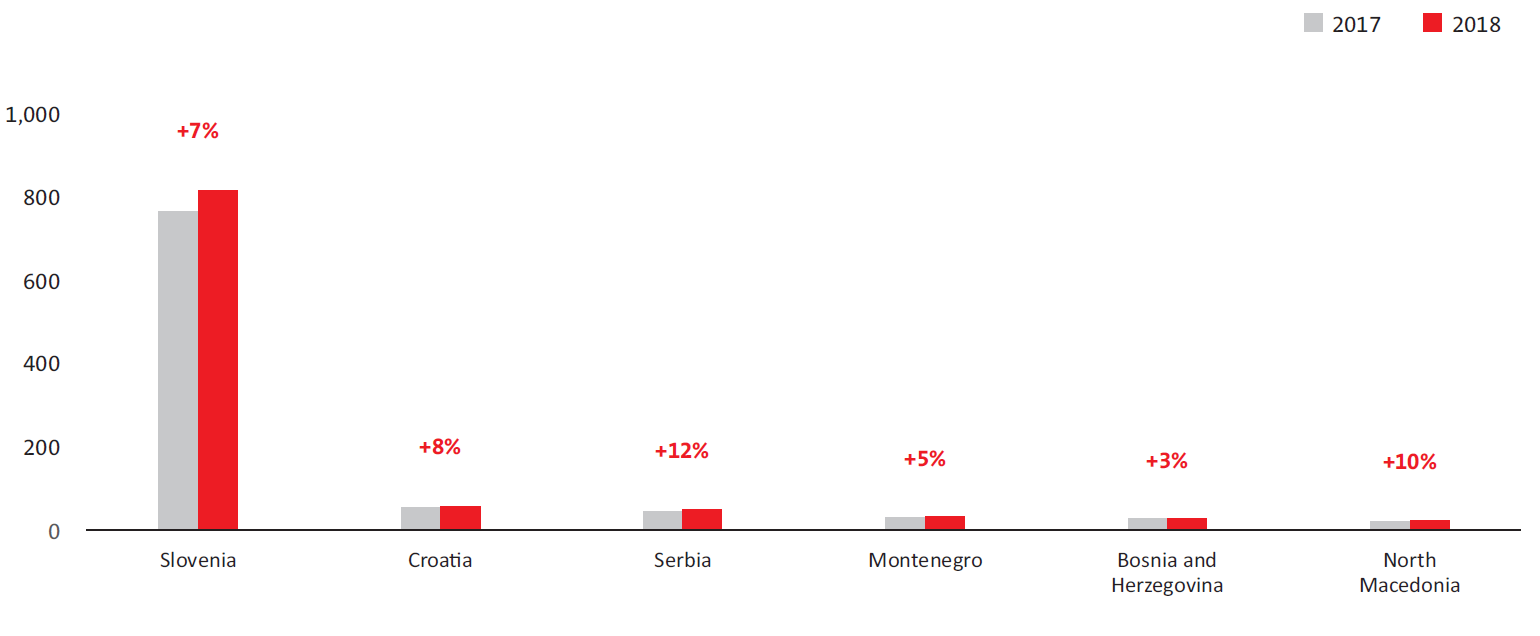

Gross written premium of the Triglav Group by market (in EUR million)

All 12 insurance companies of the Group recorded premium growth. In the Slovene market, the average growth rate was 7% and 8% in the markets outside of Slovenia. The share of premium written outside of Slovenia continued to grow. In 2018, it increased by 0.2 percentage point to 17.9%.

Claims experience, particularly mass claims, was more favourable compared to the year before. Major CAT events occurred mainly in the second quarter of 2018, but their total number and intensity were lower. Total claims paid amounted to EUR 18.3 million, which was considerably less than in 2017 and a reason for a favourable combined ratio.

Premium growth is linked to increased operating expenses, primarily due to higher acquisition costs. Operating expenses were up by 5% and below the premium growth rate. As a result, operating expenses of the insurance business fell by 0.4 percentage point and accounted for 24.5% of gross written premium.

What are your market plans and expectations?

We are the market leader in the region we cover, and want to remain that. Not only will we continue doing business in the existing markets, but we will also expand the scope of business. In the markets where the Group holds both a high market share and the leading position, we pursue consolidation strategy, and on those markets where the Group is only gaining ground, the focus is on position strengthening. Our growth is organic, but potential takeovers are not ruled out if an opportunity arises. In parallel, we use opportunities offered by the modern and dynamic business environment, by developing new business models and new ways of doing business and forging appropriate partnerships. Such a business concept enables the Group to enter the markets outside the region, but in a non-traditional way, on digital platforms, through partnerships and otherwise.

Generally, in our assessment the markets outside of Slovenia will continue to grow in the long run, and we expect that the share of total premium generated by these markets will increase further. In line with its long-term interest, the Group will continue to actively develop the existing insurance markets in the region. Our plan is to invest more in life, pension and health insurance, where maximum growth rates are expected.

What about your plans in the asset management segment?

Asset management, in the widest sense, includes the management of insurance portfolios, own assets and direct client asset management. The latter is performed by one of the Group’s members. We believe that the importance of asset management will further increase, particularly because of the need for additional savings and ensuring the sources of income in later stages of life. Regionally, Triglav wants to be a more visible asset manager and increase the volume of clients’ assets under management. To this end, several development steps were made in 2018. Thanks to an agreement to acquire Raiffeisen mirovinsko osiguravajuče društvo, the Group is entering the Croatian pension insurance market. In Slovenia, Triglav signed an acquisition agreement for Alta Skladi and bought 100% of Skupna pokojninska družba, which further increased the Group’s presence and visibility.

Social changes shape the development of the insurance product range. On what did you focus your development in 2018?

All our activities continue to be consistently client-centric, which is one of the Group’s main strategic guidelines. It is important to know the clients’ needs well. Therefore, in 2018 the Group continued to develop its client relationship management system and began to systematically measure client satisfaction and loyalty.

The Group dynamically develops client-tailored products, upgrades them with assistance services and advice, as well as implements many new ways of access to Triglav services. In this manner the existing products were redesigned and new products were launched, more client-tailored and understandable. Products were upgraded with a wide range of assistance services, as our goal is to provide to our clients not only insurance coverage but also comprehensive solutions that meet their needs. In order to make them readily easily accessible, the sales channels are being upgraded with direct access to our on-line services and with useful mobile applications. The expansion of modern sales channels and our clients’ openness will continue in all markets.

The Group is setting up a state of the art, computerised and innovative business environment, and changing its business processes towards that end. This involves a number of activities in all business processes, from taking out an insurance and insurance handling to claim settlement. Special attention is on the latter, with new technological and process improvements that arise from ever-greater digitalisation and new mobile services. At the same time, we are of course developing services for those clients who prefer to report and settle a claim using the traditional channels.

Reorganisation and redefinition of culture are prominent strategic guidelines. How will you achieve this?

The environment has changed and we are faced with new technologies and business models. Being aware of these trends we take on the challenges of the modern environment. We are building a culture of change acceptance and diversity promotion. The mobility of employees between projects and project teams as well as between organisational units and companies can certainly lead to creating such a culture. The Group is creating a stimulating work environment, which fosters systematic accumulation of modern technological knowledge and skills to help us be well prepared for the digital future. It does not help if everyone works best on their own. It is more important that we are successful together as a team. This is not about aspiring to ideals but it is about getting closer to mutual understanding, respecting diversity, relationship building, higher responsiveness and greater reliability. We need to move forward on the cooperation outside formal organisational structures and break down silo mentality.

To this end, a project is under way to develop organisational culture in Slovenia, which in 2019 will also come to fruition in Triglav’s companies in the region. We are pleased that employee engagement and satisfaction are on the rise in both the parent company and group-wide, in combination with more employee functional training that includes new technological skills.

After revising the Triglav Group Strategy, the focus remained on safe, profitable and stable operations.What concrete strategic objectives does the Group have?

In concrete terms, the Group’s credit ratings will remain within the »A« range, its average target combined ratio will be at around 95% and its return on equity will exceed 10% throughout the entire strategy period to 2022. The Group plans to expand its business and increase the share of premium written in the markets outside of Slovenia. We will stay the regional market leader. The Group’s business will be cost-effective and underpinned by integrated risk management.

How do you view the Group’s integration into the social environment?

We are a multinational group that systematically invests in the social environment and actively advocates responsible business practices. The type of projects integrated into the local environment and the broader community shows that we are an active community member. Our role in the society is clear. With our business, insurance and asset management, we will continue to provide for the financial security of individuals, families and organisations, and on the other hand reduce all risks, including climate change and cyber risks. Our goal is to remain an attractive employer and a reliable business partner. The results achieved and the realisation of the set strategy, are the result of teamwork and expertise of our employees. On behalf of the Management Board, I would like to thank all employees of the Triglav Group for their effort.